How new regulations and technologies are changing the game for shared ownership platforms

By Ryan Lock - 5 September 2025

5 Min Read

Want to own a Warhol, Federer’s tennis racket, or a Tyrannosaurus Rex skeleton? Well, now you can – or a piece of them at least.

Fractional or shared ownership has existed in some form or another for a very long time. Publicly listed companies are a good example because you can buy a small piece of them on the stock exchange. Now, regulatory, technological and economic changes have opened up fractional ownership to other industries. From stamps and sports cars to trading cards and music tracks, you can buy shares in pretty much anything these days.

As a product manager, I often wonder how product-led thinking could or should handle these changes. After all, the primary role of a product manager is to ensure the product’s success, which means considering the external factors in play, too. Because things like regulations, technologies, and the economy can be instrumental to the success of your product, they can’t simply be brushed over as ‘things beyond our control’.

Having been lucky enough to build shared ownership platforms for Collectable (USA) and Showpiece (UK) and a Web3 platform for Token Traxx (UK), we’re well versed in using product-led thinking to help our clients turn external factors into opportunities. And in the sections below, I give my take on how a product manager might consider regulation, tech, and the economy when creating or growing a shared ownership business.

Reframe regulations as an opportunity

In 2012, the USA’s Jumpstart Our Business Startups Act (JOBS Act) made it possible to take an asset and turn it into SEC-registered securities that could be bought and sold. This and subsequent regulation changes have seeded some of today’s most popular fractional ownership platforms.

Rally Rd. lead the way, offering shares in Ferraris and Pokemon cards, while Masterworks brought Banksy and Basquiat to the masses. Collectable honed in on the sports world, allowing fans to own Michael Jordan’s jersey and hundreds of other assets for as little as $10 a share. But whose job is it to identify the regulatory requirements of these shared ownership platforms?

Whilst it’s not necessarily a product manager's responsibility to figure out regulations, they should be helping the founder or CEO obtain expert advice to ensure compliance. It’s also vital that product managers understand how these regulations will impact the product from an experiential point of view. Because whether it’s omnipresent, like GDPR, or industry-specific, rules can become stellar opportunities for digital products.

Take KYC/AML, for example. Although the user has to jump through extra hoops before getting the real value from a product, every competitor in the space also has the same regulatory requirements. This turns a barrier into an opportunity. Because if your product team can deliver a best-in-class user experience, you’re already one step ahead.

Consider CX for new tech

With the days of having to ‘call a broker’ well behind us, the computer in your pocket now houses the bespoke apps that give you access to fractional ownership platforms. Advances in tech have made this possible.

Using tried and tested integrations for things like payments, contracts, and secondary market trading can make the journey fast and familiar for users. Couple this interconnectedness with a well-designed UX, and suddenly your users are investing in a matter of minutes.

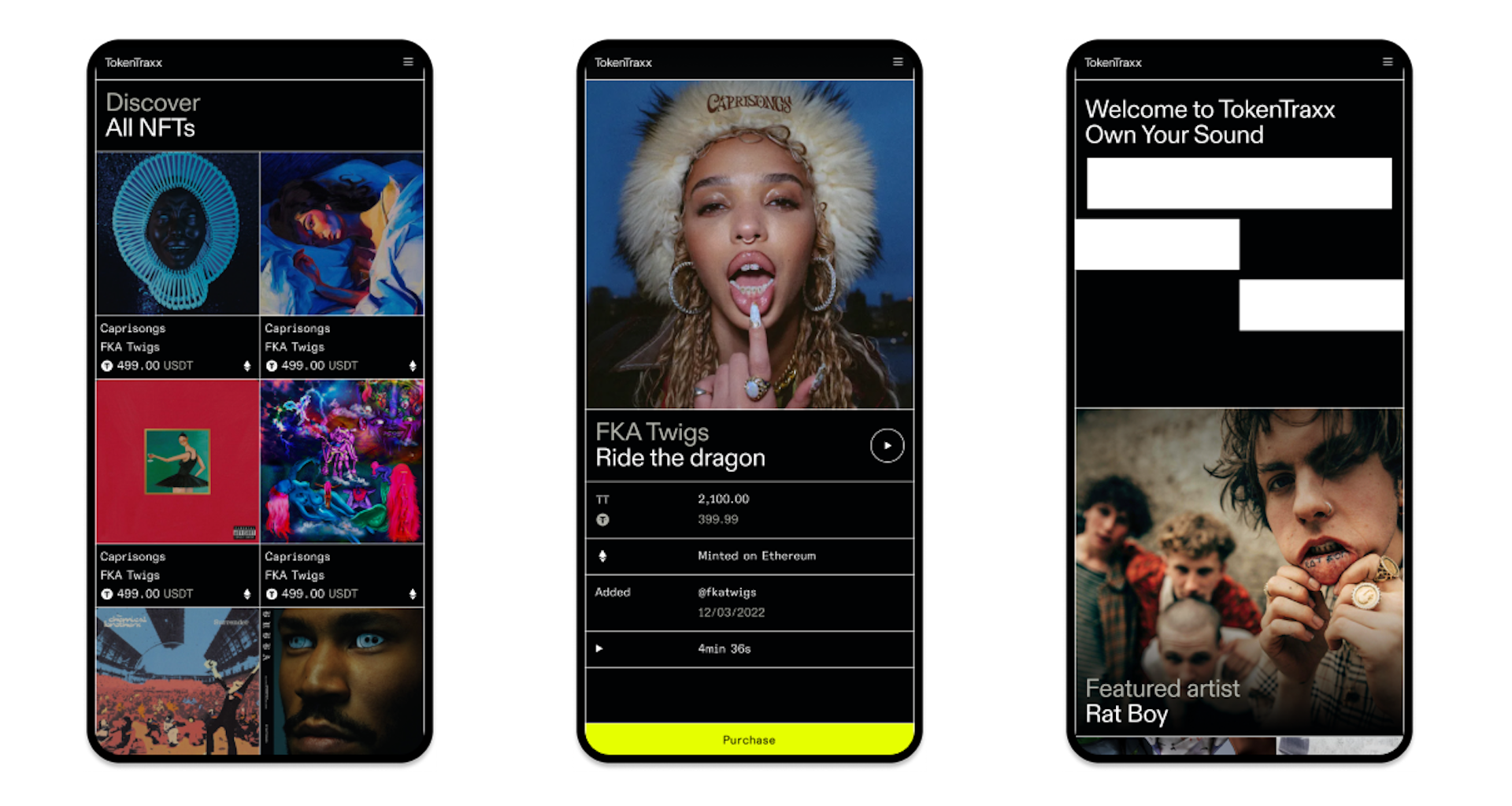

Advances in tech are also opening up other mechanisms for shared ownership. In the case of Collectable and Rally Rd., assets are ‘securitised’ by turning them into tradeable shares regulated by a government body. Web3 platforms like Token Traxx ‘tokenise’ assets via Distributed Ledger Technology (read: blockchain), which can also be used to split assets for shared ownership models to deliver better security, speed and pricing.

All this shiny new technology is quite attractive, isn’t it? But the number of times I’ve heard “let’s put it on the blockchain” without clarity on how it helps the end-user is really creeping up there. Whilst Web3 is undoubtedly unlocking greater value for users in many products (shared ownership included), too many businesses are just jumping on the hype wagon. The product team’s job is to deliver value to the end-user, and technology choices must always be in service of that.

Deliver on consumer desire as well as demand

While technology and regulation have made fractionalisation possible, I see the economy as a real catalyst for growth. Until the beginning of 2022, markets were on an insane bull run, which saw the net worth of retail investors in traditional markets balloon. With shared ownership, investors and collectors saw the opportunity to buy into assets that were actually interesting to them.

How does a product team use this information to their advantage? Given the consumer demand for alternative assets is no secret, simply meeting the demand with any old product isn’t going to cut it. The product team must therefore assess their target market’s desires to stand out from the competition.

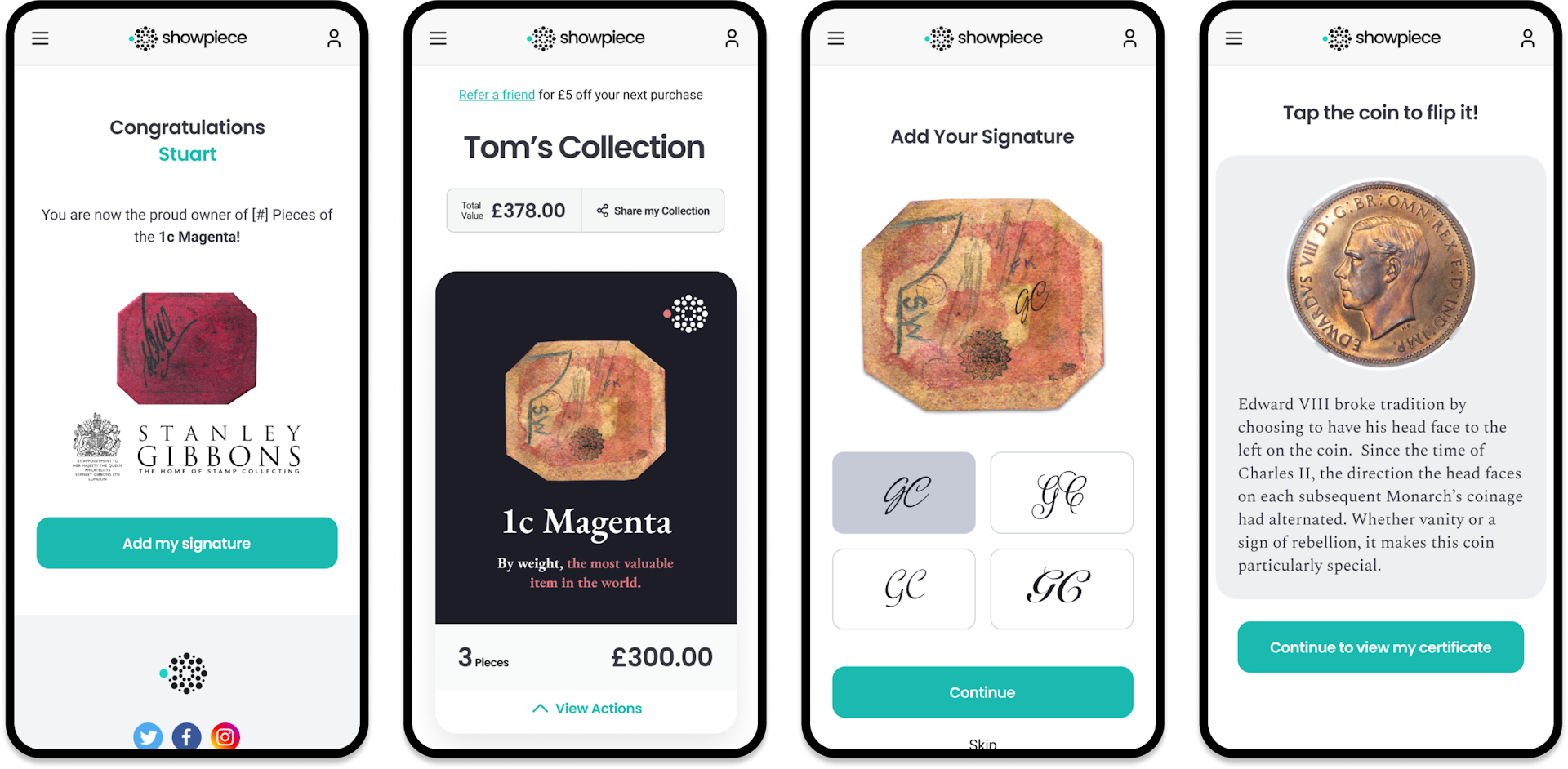

For Showpiece, our user research revealed that one of our target customer’s ‘emotional jobs’ was to feel the historical significance of what they were buying. And this makes total sense when you consider that Showpiece is a collector’s platform – designed to bring enjoyment to collectors – as opposed to an investment platform. Users didn’t want a cookie-cutter experience; they wanted to own a piece of history. To deliver this experience, we tailored each asset’s page to tell the story behind the collectable. And by applying this feedback, Showpiece was able to sell £1m in the first month.

So, what’s next?

Platforms such as Collectable and Showpiece have demonstrated that people have a great appetite for owning even a tiny piece of their most coveted collectables. Regulation and technology have opened the doors to the architects of these platforms, and economic conditions have provided the catalyst for their success. But with a full 180 in the economy in 2022, will there still be a strong interest in alternative assets?

Personally, I think people will see shared ownership as a hedge against inflation. Especially considering that the short but stark downswing in the markets at the start of COVID19 was met with the exact opposite in alternative assets. My guess is that shared ownership is just getting started.

With so much growth potential, product teams have the opportunity to create some amazing shared ownership platforms in the future. And whilst regulation and the economy are often viewed as rogue factors, it’s good to remember that even though you can’t control the wind, you can set your sails. Good product strategy around regulation and economic factors can be the wind behind those sails.